The tides are turning in the cryptocurrency world, with institutional investors making a big splash in Bitcoin exchange-traded funds (ETFs) while retail investors seem content to bob on the sidelines. A recent report by IntotheBlock paints a picture of a two-tiered market, where hedge funds and even pensions are accumulating Bitcoin through ETFs, but the average investor remains cautious.

Institutional Investors Set Sail With Bitcoin ETFs

The launch of Bitcoin ETFs on the New York Stock Exchange in early 2024 was a watershed moment, finally opening the floodgates for institutional money to enter the crypto market. This has been a boon for Bitcoin whales – investors with significant holdings – who have been snapping up large amounts of the cryptocurrency through these new financial vehicles.

IntotheBlock’s data shows that these whales have collectively amassed an additional 250,000 Bitcoins, bringing their coffers back to levels last seen before the FTX collapse in 2023.

Hedge funds, long expected to be the driving force behind institutional adoption, have lived up to the hype. Financial giants like Millennium Management have reportedly invested billions in Bitcoin ETFs, signaling their confidence in the future of the cryptocurrency. Public pensions are also getting into the game, with the state of Wisconsin making a splash with a $160 million investment in Bitcoin ETFs.

US ETF Frenzy Fizzles, But The Voyage Continues

While the initial reception for US Bitcoin ETFs was euphoric, with record-breaking inflows in January propelling the entire crypto market upwards, the party seems to be slowing down. Experts believe the early surge may have been fueled by a limited number of enthusiastic institutional adopters. Inflows have tapered off in recent weeks, suggesting a wait-and-see approach from some investors.

Across the Pacific, the recent launch of Bitcoin ETFs in Hong Kong met with a muted response. The first day of trading saw a mere $12.7 million in volume, a far cry from the $4.6 billion recorded by US ETFs on their debut. This lukewarm reception suggests that the Asian market may not be as eager to embrace the crypto just yet.

Retail Investors Drop Anchor, Unconvinced By The Hype

Adding another layer to the complex story is the apparent lack of enthusiasm from retail investors. The report highlights a significant decrease in the creation of new Bitcoin addresses, a metric often used to gauge retail participation. This suggests that many individual investors are staying on the sidelines, unconvinced by the recent surge or wary of the volatility associated with cryptocurrency.

The reasons for this hesitancy could be manifold. The FTX collapse may have left some investors with a bitter taste in their mouths, and the overall market correction in early 2024 could be prompting caution. Additionally, the complexities of ETFs, coupled with the novelty of cryptocurrency investing for some, might be creating a wait-and-see attitude among retail investors.

At the time of writing, Bitcoin was trading at $67,032, up 0.7% in the last 24 hours, and sustained an impressive 11.0% price increase in the last week, data from Coingecko shows.

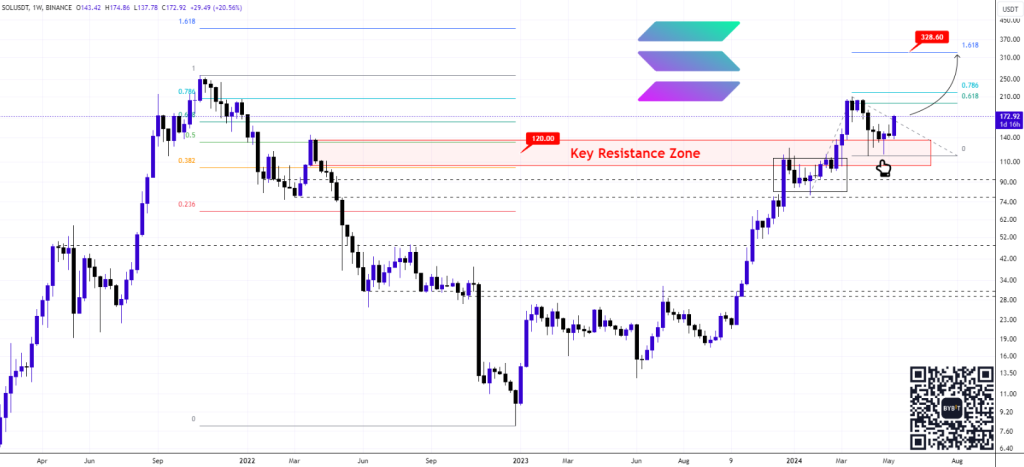

Featured image from Pexels, chart from TradingView

Credit: Source link