- Institutional Bitcoin investors have significantly increased their holdings amidst the recent price decline, acquiring over 100,000 BTC (approximately $5.7 billion) over the past week.

- Unlike earlier peaks driven by ETF inflows, this current surge in institutional holdings suggests a strategic accumulation phase rather than short-term fundraising, indicating a resilient demand from larger players amidst broader market uncertainty.

As the bitcoin price flirts around the multi-month low levels, on-chain data shows that institutional players have been buying the dips. On-chain data provider CryptoQuant recently reported that Bitcoin institutional player scooped a massive 100,000 Bitcoins over the past week. It shows that institutional players are absorbing most of the selling coming from the German government, per the CNF report.

The data reveals that Bitcoin institutional investors have been buying BTC with greater conviction than they had when BTC/USD was trading at its all-time high levels. CryptoQuant contributor Cauê Oliveira concluded this by analyzing the change in the wallet balances of entities holding between 1,000 to 10,000 Bitcoins.

These entities, which typically represent the Bitcoin institutional investor base, have increased their exposure significantly since the beginning of June, during which BTC/USD has fallen by up to 23%. Earlier this week on Monday, the Bitcoin price tanked to its lowest levels in four months dropping all the way to $53,500. However, despite this crash, the BTC buying persisted with the total increase surpassing 100,000 BTC ($5.7 billion), per the CNF update.

“While many novice investors capitulated last week, with special emphasis on coins purchased between 1 and 3 months ago, institutional players made the largest accumulation process since March,” Oliveira summarized.

In terms of the 30-day rolling balance change, the surge resembles what was observed at the peak of inflows into US-based spot Bitcoin exchange-traded funds (ETFs) in March. However, at present, with ETF inflows relatively subdued, Bitcoin’s destination appears to be elsewhere.

“This means that, unlike what was seen in March, which was a demand more linked to fundraising, the current institutional accumulation may indicate a true process of ‘buying the dip’ in large players,” Oliveira concluded.

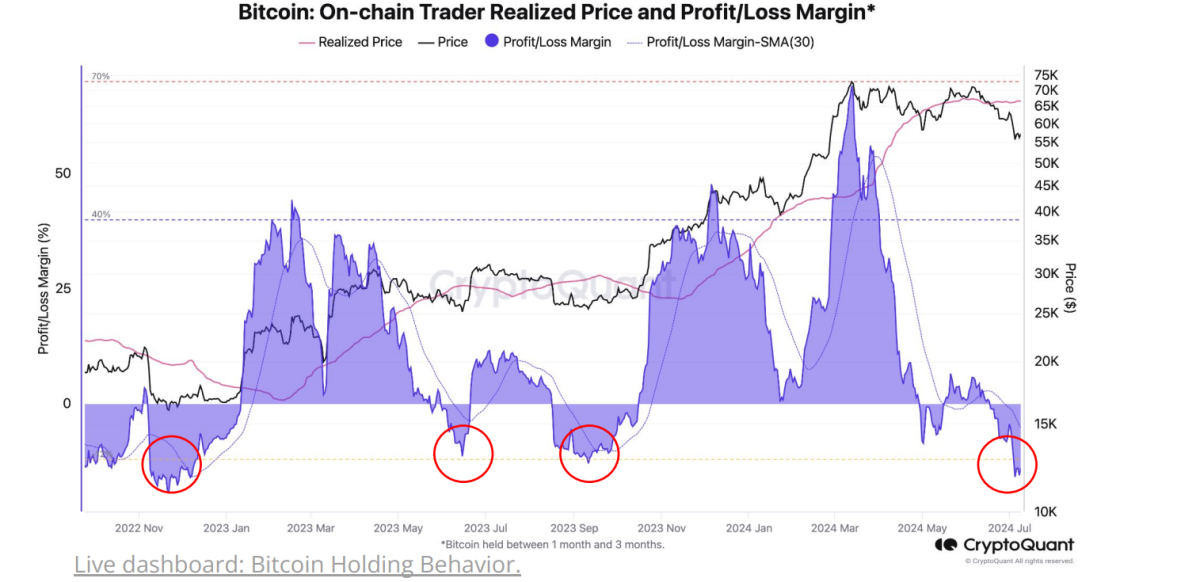

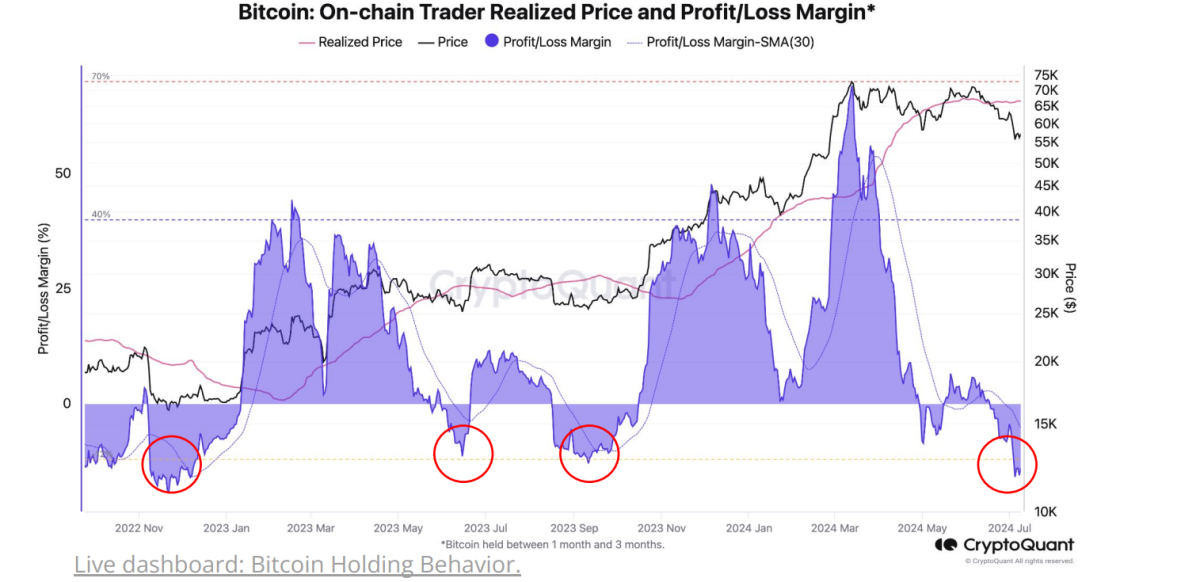

Bitcoin Trader Margins At Lowest Since FTX Collapse

Bitcoin traders are grappling with losses similar to a bear market, with a new report cautioning that recovery to higher levels could be several months away.

According to the latest Weekly Report from on-chain analytics platform CryptoQuant, Bitcoin’s market conditions are similar to that in late 2022. The cryptocurrency is encountering significant obstacles on its path back to a bull market, adding strain on both traders and miners, as reported by CNF.

In stark contrast to the prosperous days of the recent bull run just months ago, traders now face unrealized losses of 17%, marking the highest since the depths of the last Bitcoin bear market in December 2022. The report noted:

In this same tone, Bitcoin traders are now operating with negative margins, and would only realize losses if they continue to sell. Trader’s unrealized margins are now -17%, the most negative since shortly after the FTX exchange collapse in November 2022. Prices have typically bottomed-out when trader’s margins touch extremely negative levels as seen currently (red circles).

No spam, no lies, only insights. You can unsubscribe at any time.

Credit: Source link