Este artículo también está disponible en español.

Cathie Wood, CEO of asset manager and crypto ETF issuer ARK Invest, has long maintained her bullish outlook on Bitcoin, and her recent comments reinforce her optimistic projections for the largest cryptocurrency.

Following Donald Trump’s electoral victory over Vice President Kamala Harris last week and Bitcoin’s recent surge to an all-time high of $93,250, investor sentiment surrounding Bitcoin has notably improved.

Anticipated Regulatory Relief

In a recent interview on CNBC’s Squawk Box, Wood discussed her expectations for Bitcoin’s price trajectory. She stated that ARK Invest’s targets for 2030 range between $650,000 and, in a bullish scenario, between $1 million and $1.5 million.

Ark’s CEO attributed the current uptrend in Bitcoin’s value to several catalysts, particularly the anticipated regulatory relief that could come from Trump’s new administration.

Related Reading

The now 47th President of the United States has vowed to make significant changes, particularly in the leadership of the US Securities and Exchange Commission (SEC), headed by Gary Gensler and characterized by lawsuits, Wells Notices and increased scrutiny of key industry players.

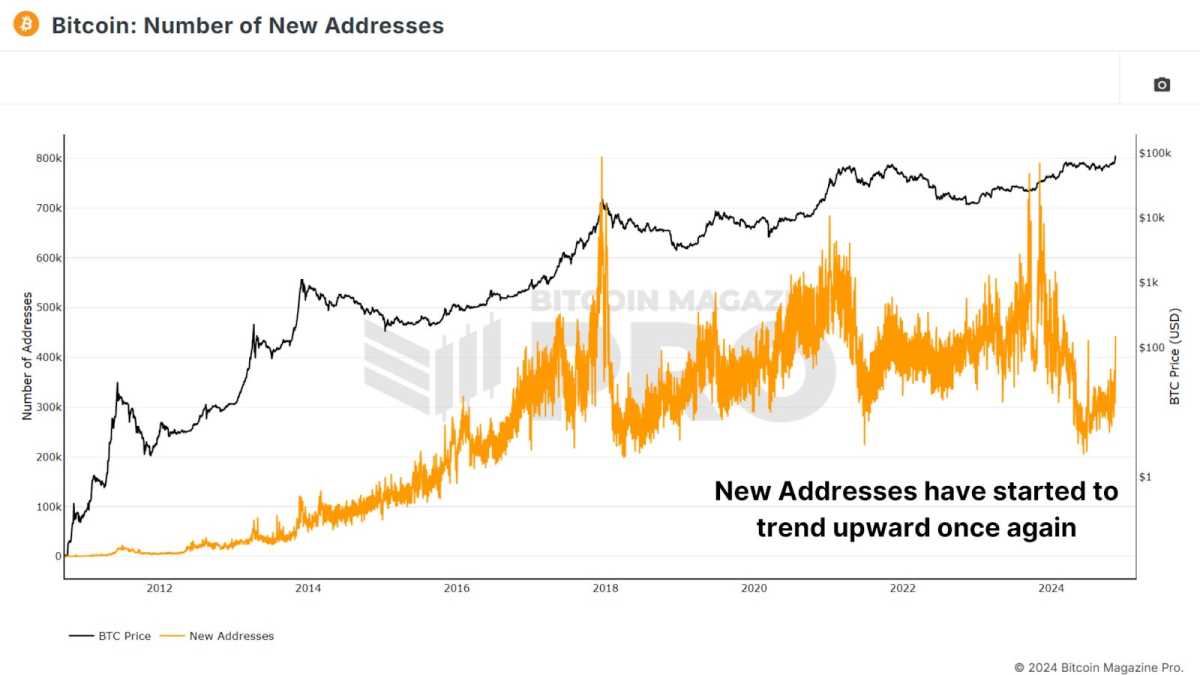

This has led to notable discontent over the past three years of his tenure at the regulatory agency, prompting executives and investors in the digital asset ecosystem to call for a change for a clearer regulatory framework that could invite further adoption and growth of the market.

However, Trump promised to fire Gary Gensler on the first day of his new administration, which is expected to begin on January 20. He also vowed to make America the “crypto capital of the world” with a new framework and support for digital assets, with Bitcoin at the center of his economic agenda.

This has resonated well with industry advocates, as evidenced by the broader market rally led by the market’s largest digital assets, which have risen nearly 25% since Trump’s election victory.

Bitcoin As A Unique Asset Class

During the interview, Wood also highlighted that ARK Invest was the first public asset manager to invest in Bitcoin when it was priced at just $250 in 2015. The asset manager believes that even at approximately $90,000, Bitcoin still has significant growth potential.

According to Wood, Trump’s victory is pivotal, as it signals a shift toward a more favorable regulatory environment for the cryptocurrency sector—an outcome she views as crucial for Bitcoin’s future.

Related Reading

Furthermore, Wood emphasized that Bitcoin has evolved into a distinct asset class, separate from traditional currencies. She believes that this shift indicates that institutional investors and asset allocators are increasingly looking to include Bitcoin in their portfolios, recognizing its potential as both a store of value and a hedge against inflation.

At the time of writing, BTC is hovering around the $90,120 mark, still up 16% in the weekly time frame, despite the current retracement experienced over the past 48 hours.

Featured image from DALL-E, chart from TradingView.com

Credit: Source link