Bitwise CIO Matt Hougan has predicted that the impending spot Ethereum exchange-traded funds (ETFs) will see a $15 billion net flow within their first 18 months of trading.

Hougan shared this forecast on June 26, basing his prediction on Ethereum’s market capitalization relative to Bitcoin, data from international ETP markets, and the potential influence of the carry trade strategy.

However, he acknowledged the possibility of net outflows from the ETH ETPs after the initial launch, considering traders involved in discount arbitrage aggressively redeem their positions from Grayscale Ethereum Trust (ETHE). A similar trend was observed from Grayscale’s Bitcoin Trust when the Bitcoin ETFs were launched in January.

Despite this, Hougan believes the Ethereum ETPs will succeed because the underlying asset is one of the best-performing assets ever.

BTC and ETH relative size

The Bitwise CIO explained that he expects investors to allocate funds to spot Bitcoin and Ethereum ETFs in proportion to their market caps, which are currently $1.26 trillion and $432 billion, respectively. This suggests a weighting of around 74% for Bitcoin ETFs and 26% for Ethereum ETFs.

Hougan furthered that US spot Bitcoin ETF’s assets under management (AUM) should increase to at least $100 billion by the end of 2025 as these products mature and gain approval on platforms like Morgan Stanley.

Considering this, Hougan stated that Ethereum ETFs must attract $35 billion in 18 months to reach parity. However, when Grayscale Ethereum Trust’s $10 billion AUM is removed, the figure drops to $25 billion.

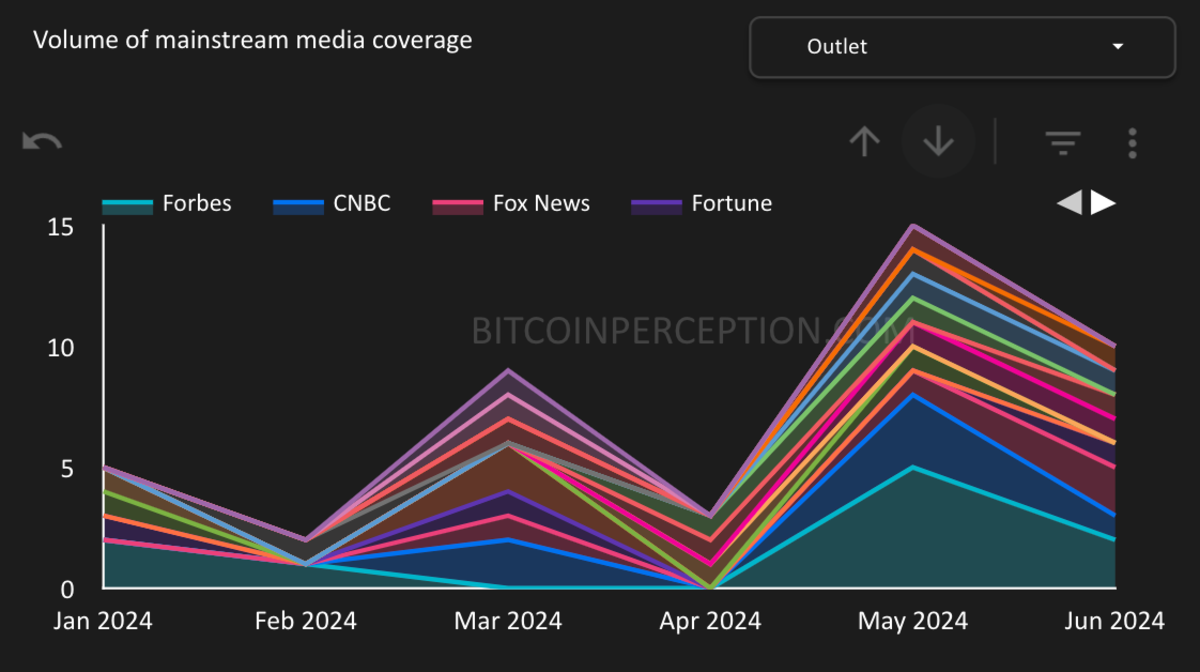

International ETP

Hougan noted that data from the European Bitcoin and Ethereum ETP markets revealed AUM ratios of 78% for Bitcoin and 22% for Ethereum products. In Canada, these figures stood at 77% for Bitcoin and 23% for Ethereum.

According to him, the similarity in asset splits between the two regions suggests that this distribution reflects the relative demand for Bitcoin and Ethereum among ETP investors. Hougan stated:

“The fact that the split is roughly in line with the relative market capitalization of the two assets adds to my confidence that this kind of break-down reflects “normal” demand.”

Using Europe’s 22% market share as a proxy, Hougan adjusted his expected net flows from $25 billion to $18 billion.

Carry trade

Hougan also highlighted “the carry trade” as one important factor impacting Ethereum ETF flows. A carry trade is a trading strategy in which investors arbitrage the difference between an underlying asset’s spot and futures prices.

The Bitwise CIO noted that around $10 billion of spot Bitcoin ETF AUM is tied to this trading strategy. However, he doesn’t expect spot Ethereum ETFs to follow the same pattern because “carry trade is not reliably profitable in ETH for non-staked assets.”

He added that he does not expect carry trading to impact the AUM of spot Ethereum ETFs. Considering this, Hougan cut his estimate for net inflows into spot Ethereum ETFs to $15 billion.

According to him:

“[This number] would be a historic success [as] only four ETFs launched since January 2020 have gathered $15 billion in flows.”

Mentioned in this article

Credit: Source link