For years, Bitcoin enthusiasts have been expecting a significant change in the value due to the involvement of institutional investors. The concept was simple: as companies and large financial entities invest in Bitcoin, the market would experience explosive growth and a sustained period of rising prices. However, the actual outcome has been more complex. Although institutions have indeed invested substantial capital in Bitcoin, the anticipated ‘supercycle’ has not unfolded as predicted.

Institutional Accumulation

Institutional participation in Bitcoin has significantly increased in recent years, marked by substantial purchases from large companies and the introduction of Bitcoin Exchange-Traded Funds (ETFs) earlier this year.

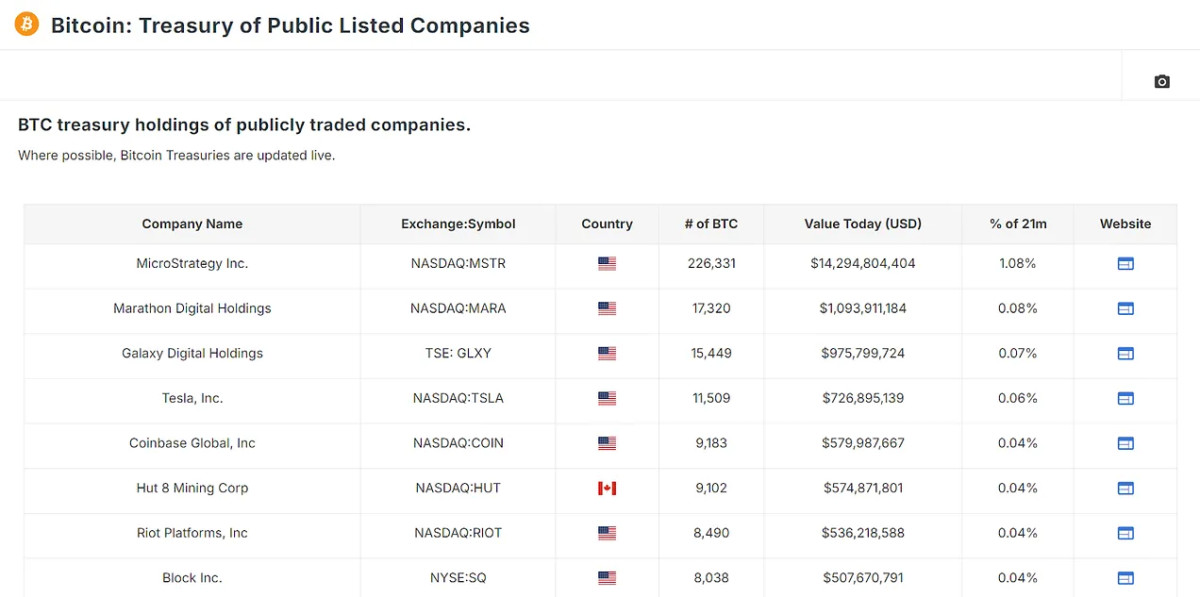

Leading this movement is MicroStrategy, which alone holds over 1% of the total Bitcoin supply. Following MicroStrategy, other prominent players include Marathon Digital, Galaxy Digital, and even Tesla, with significant holdings also found in Canadian firms such as Hut 8 and Hive, as well as international companies like Nexon in Japan and Phoenix Digital Assets in the UK; all of which can be tracked via the new Treasury data charts available on site.

In total, these companies hold over 340,000 bitcoin. However, the real game-changer has been the introduction of Bitcoin ETFs. Since their inception, these financial instruments have attracted billions of dollars in investments, resulting in the accumulation of over 91,000 bitcoin in just a few months. Together, private companies and ETFs control around 1.24 million bitcoin, representing about 6.29% of all circulating bitcoin.

A Look at Bitcoin’s Recent Price Movements

To understand the potential future impact of institutional investment, we can look at recent Bitcoin price movements since the approval of Bitcoin ETFs in January. At the time, Bitcoin was trading at around $46,000. Although the price dipped shortly after, a classic “buy the rumor, sell the news” scenario, the market quickly recovered, and within two months, Bitcoin’s price had surged by approximately 60%.

This increase correlates with institutional investors’ accumulation of Bitcoin through ETFs. If this pattern continues and institutions keep buying at the current or increased pace, we could witness a sustained bullish momentum in Bitcoin prices. The key factor here is the assumption that these institutional players are long-term holders, unlikely to sell off their assets anytime soon. This ongoing accumulation would reduce the liquid supply of Bitcoin, requiring less capital inflow to drive prices even higher.

The Money Multiplier Effect: Amplifying the Impact

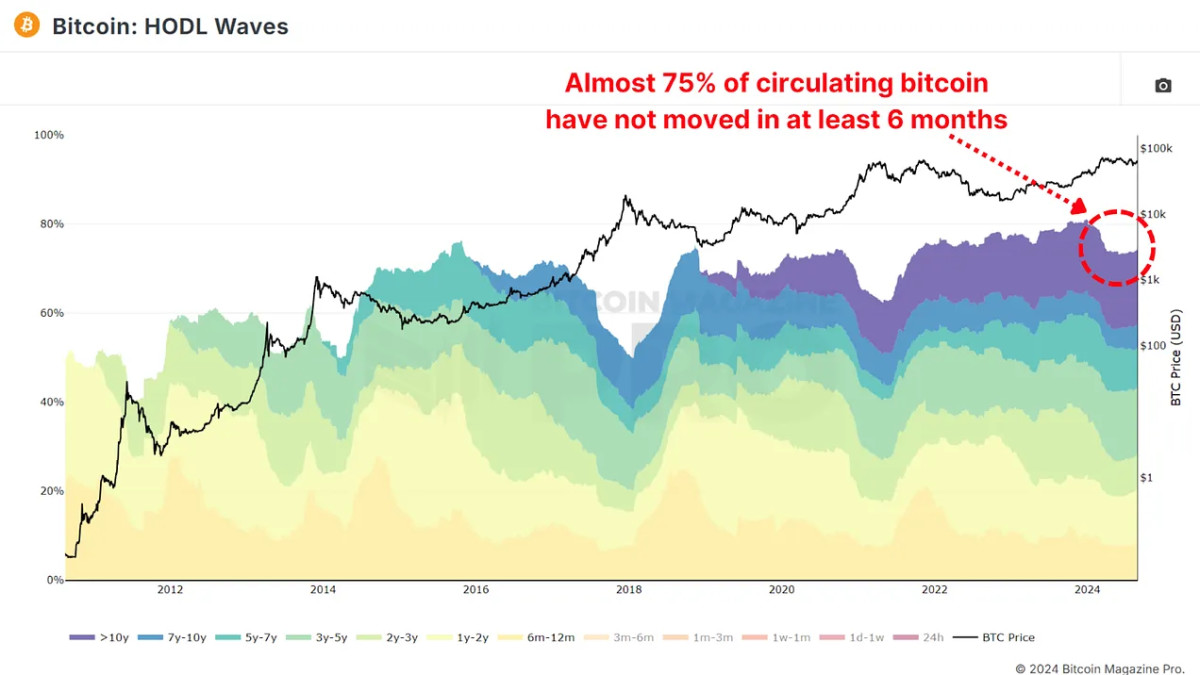

The accumulation of assets by institutional players is significant. Its potential impact on the market is even more profound when you consider the money multiplier effect. The principle is straightforward: when a large portion of an asset’s supply is removed from active circulation, such as the nearly 75% of supply that hasn’t moved in at least six months as outlined by the HODL Waves, the price of the remaining circulating supply can be more volatile. Each dollar invested has a magnified impact on the overall market cap.

For Bitcoin, with roughly 25% of its supply being liquid and actively traded, the money multiplier effect can be particularly potent. If we assume this illiquidity results in a $1 market inflow increase in the market cap by $4 (4x money multiplier), institutional ownership of 6.29% of all bitcoin could effectively influence around 25% of the circulating supply.

If institutions were to begin offloading their holdings, the market would likely experience a significant downturn. Especially as this would likely trigger retail holders to begin offloading their bitcoin too. Conversely, if these institutions continue to buy, the BTC price could surge dramatically, particularly if they maintain their positions as long-term holders. This dynamic underscores the double-edged nature of institutional involvement in Bitcoin, as it slowly then suddenly possesses a greater influence on the asset.

Conclusion

Institutional investment in Bitcoin has both positive and negative aspects. It brings legitimacy and capital that could drive Bitcoin prices to new heights, especially if these entities are committed long term. However, the concentration of Bitcoin in the hands of a few institutions could lead to heightened volatility and significant downside risk if these players decide to exit their positions.

For a more in-depth look into this topic, check out a recent YouTube video here:

Credit: Source link